The American Medical Association (AMA) released an analysis indicating that medical liability premiums have experienced a prolonged period of upward volatility, extending into the fourth consecutive year. This suggests that a hard insurance market has spread across multiple states, making it challenging for physicians to obtain affordable coverage.

The study shows that between 2019 and 2022, there has been a remarkable increase in year-to-year medical liability premiums. As a result, doctors are finding it increasingly challenging to obtain reasonably priced insurance.

“There is a growing consensus that a hard medical liability insurance market exists in many states and is slowly spreading across the U.S. as more physicians face higher insurance premiums. For physicians who can still obtain coverage in a hard market, the skyrocketing costs may force physicians to relocate away from certain high-cost states or drop certain critical services that raise their liability risk. These tough choices can lead to reduced access to care for patients.” AMA President Jack Resneck Jr.

The analysis concluded that if current trends continue, “this medical liability pressure could have detrimental effects on health care markets, such as an increase in defensive medicine, lower physician supply, and thus reduced access to care.”

Revealing Hard Truths and Markets: The Analysis

Every year, The Medical Liability Monitor (MLM) surveys liability insurers in the United States to gather data on medical professional liability premiums. The survey results are regularly updated, including the latest report from October 2022. The MLM’s annual survey is widely regarded as the most comprehensive source of information on this topic.

The most notable finding reveals that between 2019 and 2022, the proportions of premiums that increased year-to-year reached levels not seen since the 2000s. In 2019, the percentage of year-to-year premium increases nearly doubled, rising from 13.7% in 2018 to 26.5%. Subsequently, between 2020 and 2022, roughly 30% of premiums increased over that period.

Medical liability premiums have consistently risen:

-

- The percentage of premium increases almost doubled in 2019, rising from 13.7% in 2018 to 26.5% in 2019.

- In 2020, medical liability premium increase rose further by 31.1%.

- A negligible decline in medical liability premium cost occurred in 2021.

- Medical liability premiums rose again in 2022, with 36.2% of premiums increasing in 2022.

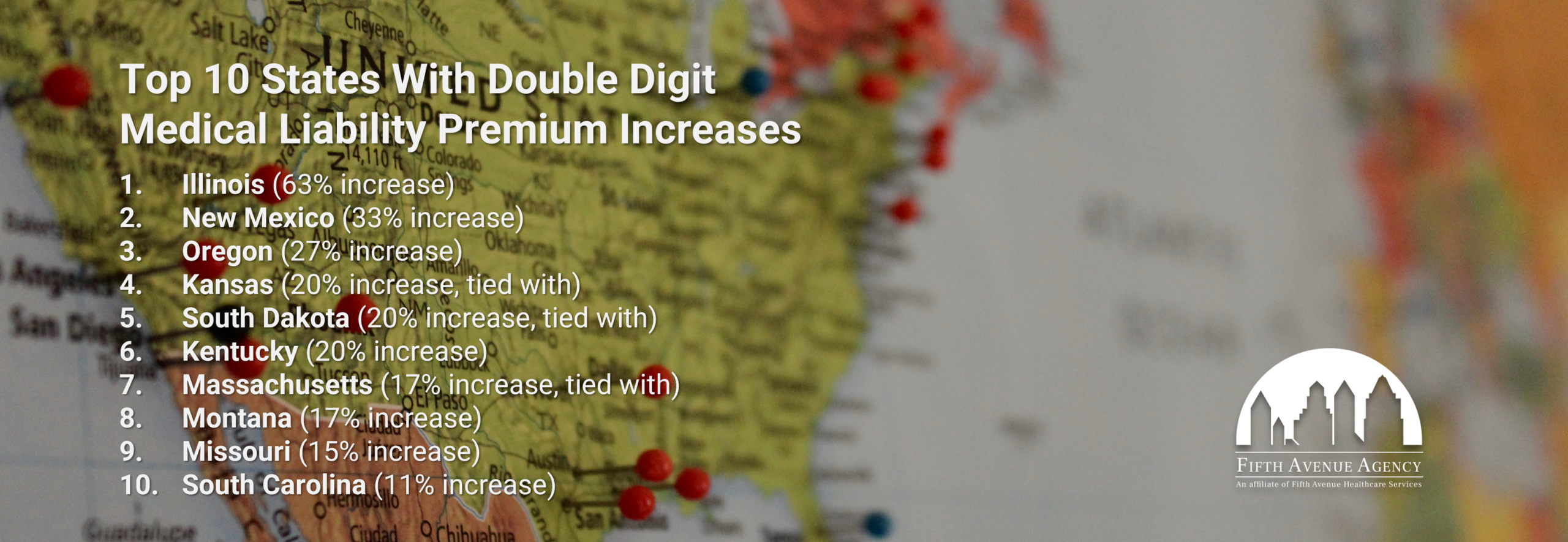

Identifying the Hardest Markets: The Top 10 States

The Insurance Risk Management Institute defines a hard market as an “upswing in the insurance market cycle when premiums increase, coverage terms are restricted, and capacity for most types of insurance decreases.” Insurance becomes more expensive and difficult to acquire during hard markets, which can be caused by a range of factors, such as insurers experiencing declining investment returns, an increase in the frequency or severity of losses, or regulatory intervention that is perceived to be against the interests of insurers.

According to the AMA survey, 15 states were the top hard markets, leading the country. Of all the 2022 premium increases, 68.2% were observed in 10 states, with 78% occurring in 15 states. Among these states, Illinois had the highest number of increases in the last three years, accounting for 30% of the total increases.

Looking at other relevant statistics and facts might fill in a blank and troubling picture.

Here are the Top 10 States with Medical Liability Premium Increases.

1. Illinois (63.6% of medical liability premiums increased)

An analysis of medical malpractice lawsuits by the state found Illinois as the state with the 5th most significant medical malpractice compensation awards from 1990 to 2020, with $9.5 billion in payouts. The state sees an average of 1,600 yearly lawsuits with a typical payout of just over $200,000.

According to the AMA report, Illinois physicians (OB/GYN, general surgery, and internal medicine) paid an average of approximately $133,000 in medical professional liability insurance premiums for $1M/$3M policies in 2022. In 2013, that figure was around $112,000.

2. New Mexico (33% increase)

From 1990 to 2020, New Mexico’s total malpractice payouts is just under $1 billion, averaging $105,000 per case. The state has seen around 9,100 cases during the same period.

3. Oregon (26.7% increase)

Oregon has only had 21,000+ malpractice cases in 30 years. With $1.2 billion in awards during this time, the average amount awarded is $58,000. Unfortunately, the state was recently listed as one of the worst for physicians based on opportunities and medical environments.

4. Kansas (20% increase, tie with)

Kansas lags behind other states, seeing an average of 470 lawsuits annually with awards of $80,000 per case. This average might see a bump due to a 2022 judgment. A jury found Dr. Kelli Sandri guilty of medical negligence and the plaintiff a record $25.4 million judgment. Experts believe it to be the largest verdict awarded in the Kansas City Metropolitan Area and surrounding counties.

5. South Dakota (20% increase, tie with)

With one of the lowest numbers of medical malpractice suits filed between 1990 and 2020 (3,042), South Dakota understandably ranks low in total awards with barely $285 million. In 2019, there were 141 cases. However, the average payout of cases over 30 years is around $94,000.

6. Kentucky (20% increase, tie with)

The Bluegrass State has a relatively low number of cases, averaging 702 annually. The typical payout is more mid-range at a bit over $70,000. According to one article, Kentucky ranks as the top state to practice medicine based solely on the median physician salary. However, it would rate near the bottom if other factors, such as burnout rate, healthcare quality, and malpractice suit frequency, were considered. Growing insurance rates are sure to contribute to its low rank.

7. Massachusetts (16.7% increase)

Massachusetts has had just under 26,000 lawsuits from 1990 to 2020. However, payouts have totaled $5 billion+. The average award is approximately $196,000. These figures could be even higher, but Massachusetts is 1 of 7 states with the highest percentage of carriers’ claims closed without payment.

8. Montana (16.7% increase)

Montana is another state with the fewest cases (4,570). The 30-year total amount awarded is relatively low, with $493 million. This figure has not dissuaded healthcare providers from abandoning the state. A recent article concluded that Montana is the best state to practice medicine.

9. Missouri (14.8% increase)

Missouri’s total awards from 1990 to 2020 nearly top the list at $2.6 billion with under 30,000 cases. The average payout is a paltry $89,000 when compared to its neighbors.

10. South Carolina (11% increase)

The Palmetto State’s 16,500 cases in 30 years are on the low end of the national scale. The total amount awarded skews high at around $1.2 billion.

Top 11 – 15 States That Saw Medical Liability Premiums Increase

As the list continues with The Top States 11-15, there is no double-digit medical liability premium increase; however, there are a few noteworthy reading points.

11. West Virginia (6.7% of medical liability premiums increased)

West Virginia, another state with fewer cases and higher awards, is a bit of an anomaly. In 3 decades, the Mountain State has had 11,000+ suits that have awarded $1.2 billion. The average award is nearly $107,000.

12. Maine (6.7% increase)

Maine’s medical malpractice statistics seem to pale compared to the rest of the country’s. There have only been 7,000 lawsuits from 1990 to 2020. The total amount awarded during this time is approximately half a billion dollars. Like Massachusetts, this number could be much higher, but Maine boasts a high percentage of closed claims without payment.

13. Virginia (6% increase)

Virginia’s medical malpractice lawsuit statistics are in line with the national average. The state averages 1,265 suits a year with awards in the range of $59,000. However, a recent lawsuit could boost that amount.

David Jeck has filed a medical malpractice lawsuit against Fauquier Hospital and three of its staff members in Fauquier County, Virginia. According to Jeck, their negligence caused the death of his son seven days after being admitted to the hospital’s emergency department. The lawsuit, filed on November 13, 2022, could become one of the most expensive in US history, as Jeck seeks $15 million in damages.

14. Nevada (5.6% increase)

The Silver State’s numbers are borderline average, with around 12,000 cases in 30 years that saw $987 million awarded.

15. Georgia (4.8% increase)

Georgia’s nearly 24,000 medical malpractice cases might not appear noteworthy. However, its 30-year award average can give pause. $3.8 billion+ have been awarded. Many doctors find Georgia appealing due to its low burnout rate and cost of living despite these figures and the increase in liability premiums.

Expensive MPLI Coverage: The Causes and Consequences

It is unclear what lone factor is causing the increases in MPLI premiums. Insurance companies have historically attributed increased costs to various elements, including higher severity of claims with more significant payouts, increased legal fees, and economic inflation. The COVID-19 public health emergency has also been pointed to as a reason for the current spike.

Medical Liability Premium Costs Increases And COVID-19

Insurers’ responses to the COVID-19 pandemic in 2020, including offering premium discounts and rebates, led to a temporary reduction in healthcare services and, as a result, lower exposure to the risk of claims. Therefore, the pandemic’s impact on MPLI premiums has been primarily insignificant.

Medical Liability Premium Costs Increases And Smaller Markets

One explanation for the MPLI premium increases is the smaller size of the MPLI market. In the past, if an insurer raised premiums and lost customers, they could compete with other insurers and acquire new customers. However, recent changes in physician practice arrangements, where healthcare entities now employ physicians, have made it harder for insurers to replace lost businesses.

Medical Liability Premium Costs Increases And Unfortunate and Unfavorable Results

Whatever the reasons, the effects may become more apparent in the upcoming months. Healthcare providers may find it harder to afford coverage, which could result in some physicians or healthcare facilities closing or reducing services. Another consequence is an increase in healthcare costs.

Providers may pass on the cost of MPLI to patients through higher fees or insurance premiums, which could be detrimental to patients. Rising premiums may also lead to a shortage of healthcare providers in certain specialties or regions. Healthcare providers may retire early, move to areas with lower premiums, or work in lower-risk fields.

Lowering MPLI Premiums: The Solutions

Reduce Medical Liability Premium Costs: Partner With MPLI Experts

Physicians should team up with an MPLI solution to find affordable coverage. The experts at Fifth Avenue Agency can analyze the medical malpractice needs of providers and propose a custom solution. Once the proposal is accepted, they can efficiently implement the plan.

Fifth Avenue Agency’s recent expansion into the Illinois market is well-timed as Illinois has the highest rate increases. The highly experienced medical malpractice and MPLI team can assist providers in reducing their costs and medical liability.

Reduce Medical Liability Premium Costs: Perform Due Diligence

Healthcare providers should determine the necessary amount and type of coverage they require. Such information helps them secure the coverage they need more efficiently and potentially at a lower premium.

With this information on hand, they should then ask the following questions of prospective insurance carriers:

-

- What percentage of the carrier’s claims are closed without payment?

- What is the carrier’s trial win percentage?

- What is the carrier’s A.M. Best rating?

- How much of a doctor’s salary goes to medical malpractice insurance?

- How does my practice specialty affect the cost of medical malpractice insurance?

Reducing Medical Liability Premium Costs: Reduce Risk

The first step to lowering insurance premiums is to reduce risk. Compassion, communication, competence, and charting are paramount to adequate and safe healthcare. Listening and communicating with patients can reduce negligence claims against physicians. Effective communication includes explaining diagnoses and treatment plans and answering questions, which can strengthen the physician-patient bond and improve patient recovery.

Physicians must adhere to standards of care and maintain competence in their field. Proper charting is crucial for effective diagnosis and treatment.

The Future of MPLI Premiums and Health Care

An MPLI cost increase might seem trivial initially, but it could be the start of financial troubles for thriving providers and practices. A proactive approach can help mitigate the impact of high insurance premiums and provide peace of mind in an uncertain future.

More information about Fifth Avenue Agency

Fifth Avenue Agency specializes in MPLI and medical malpractice insurance, serving 1000s of providers nationwide. Fifth Avenue Agency is part of the Fifth Avenue Healthcare Services family. Sister companies include 5ACVO (credentialing and primary source verification specialists) and Primoris Credentialing Network (credentialing and provider enrollment specialists with 54+ health plan and network provider enrollment options).

Fifth Avenue Agency initially published this article here. For information on Fifth Avenue Agency, please visit FifthAvenueAgency.com or Contact Us.